Insurance can seem like a language all its own. Between terms like deductible, premium, and coverage limit, many people feel lost before they even finish reading the first page of their policy. Yet, insurance exists to offer peace of mind, not confusion. The secret to feeling confident about your protection lies in understanding the words that shape your policy. Once those definitions make sense, everything about your coverage becomes clearer.

Let’s take a friendly walk through the essential insurance words that everyone encounters. By the end, you will be able to read your policy with confidence and know exactly what you are signing up for.

Every insurance policy starts with the premium. This is the amount you pay to keep your coverage active. Some people pay monthly, while others pay every six months or once a year. The amount depends on several factors, like the type of insurance, the coverage amount, and your personal situation. For example, if you have auto insurance, your driving record might affect your premium. The key idea is simple: paying your premium keeps your policy in force so that the insurer is ready to help when needed.

Next comes the deductible, a word that often causes uncertainty. The deductible is the portion of a claim that you pay out of pocket before your insurance company contributes. If your car repair costs one thousand dollars and your deductible is two hundred, you pay that two hundred, and your insurer covers the rest. A higher deductible usually means a lower premium, and a lower deductible often comes with higher monthly costs. Understanding this trade-off helps you choose what fits your budget and comfort level.

Another important term is coverage, which represents the protection your policy provides. It outlines what situations are included and what types of losses are paid for. Coverage can apply to property, health, liability, and more. For example, in health insurance, coverage determines which medical services are included. In home insurance, it defines the parts of your property that are protected from damage. Knowing the details of your coverage ensures that you are never caught off guard when you need help most.

Every policy has something called a policy limit, which defines the maximum amount your insurer will pay for a covered loss. If damages exceed that limit, you are responsible for the remaining costs. Choosing the right policy limit is like deciding how big a safety net you want. Too low, and you might not have enough protection. Too high, and you might pay more than necessary for your premium. The goal is balance—adequate security without overspending.

Then there is the claim, a word that becomes important when something actually goes wrong. A claim is your formal request for your insurer to pay for a covered event. Filing a claim involves explaining what happened, providing documentation, and waiting for the insurer’s review. Understanding how to file a claim and what to expect during the process helps you stay calm during stressful times.

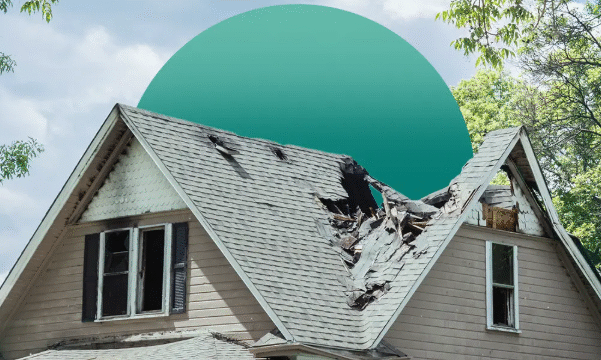

Another word that often appears is exclusion. An exclusion lists what your insurance does not cover. This section might seem negative, but it’s actually one of the most helpful parts of your policy. It clearly defines the limits of your protection so you can plan accordingly. For example, certain natural disasters might be excluded from a standard homeowner’s policy, but you can usually add extra coverage for an additional cost.

You might also come across the term endorsement, sometimes called a rider. This refers to a change or addition to your original policy. Endorsements allow you to customize your insurance. If you want to include additional coverage for jewelry in your homeowner’s policy, for example, you can add an endorsement that specifically protects those valuable items.

A key word in life and health insurance is beneficiary. This person receives the financial benefit if the insured passes away. Choosing the right beneficiary is an important step in any policy because it ensures that your loved ones are supported according to your wishes.

Another phrase that can appear in almost every type of policy is underwriting. This is the process insurers use to evaluate risk and determine your premium. It might involve reviewing your driving record, health history, or property condition. Understanding underwriting helps explain why premiums differ from person to person.

In many policies, you will also find a section about liability. Liability coverage protects you if you are legally responsible for harm or damage to others. It can cover legal fees, settlements, or medical expenses. This protection is especially important in auto and homeowner’s insurance because accidents can happen to anyone.

The term term itself has special meaning in insurance. It refers to the duration of your policy. Some policies renew annually, while others, such as life insurance, can cover a fixed number of years or an entire lifetime. Knowing your policy’s term helps you plan for renewals and ensures continuous coverage.

You might notice references to replacement cost and actual cash value in property insurance. Replacement cost means your insurer will pay the amount needed to replace or repair your property with new materials of similar kind and quality. Actual cash value, on the other hand, considers depreciation—the reduction in value over time. Understanding the difference between these two helps you know what to expect after a loss.

Another useful word is grace period, which is the time you have to make a late payment before your policy lapses. It provides a small cushion in case life gets busy or an unexpected expense delays your payment.

Lastly, there’s the concept of renewal. Insurance renewal is when your policy continues after the current term ends. During renewal, you can review your coverage, make adjustments, and check if your premium has changed. Taking the time to understand renewal terms helps you maintain uninterrupted protection.

By learning these definitions, you begin to see that insurance is not as mysterious as it appears. It is a system built on clear ideas that protect people from unexpected losses. Knowing what each word means turns your policy from a stack of papers into a tool for peace of mind.

Confidence in insurance does not come from memorizing every rule or number; it comes from understanding the language that shapes your protection. The more familiar you become with these terms, the easier it becomes to make smart choices about your coverage. You can compare policies more clearly, ask better questions, and feel assured that you are getting what you need.

Insurance definitions are more than just words on a page—they are the foundation of security, stability, and trust. Once you know how to read them, you hold the power to make informed decisions that protect the people and things that matter most. With everyday confidence, you can face life’s uncertainties knowing that your policy is not a mystery, but a promise written in words you now understand.